Seeking Relief: SEC Reporting for Smaller Reporting Companies

Details

The COVID-19 pandemic has triggered market volatility previously unseen by many companies. While certain industries were hit especially hard, a growing number of companies across the board are feeling the impact through a decline in market capitalization. Investors recognize that this decline has been significant for small and mid-size companies and we may not see full market recovery in the near future.

As the economic landscape continues to evolve, companies have an opportunity to seek relief from certain SEC filing and disclosure reporting requirements.

The SEC permits an issuer that meets certain criteria to take advantage of less onerous disclosure requirements in its Securities and Exchange Acts filings. The trigger that provides an issuer with this relief is determined by reference to the issuer’s public float as of the last business day of the issuer’s most recently completed second fiscal quarter.

Companies should be aware that the filing designation is subject to SEC review and comment.

SRC Designation

SEC Regulation S-K provides the detailed disclosure requirements (other than financial statement requirements which are provided under SEC Regulation S-X) applicable to filings under the Securities and Exchange Acts.

An issuer qualifies as an SRC if it has public float of less than $250 million or it has less than $100 million in annual revenues and public float of less than $700 million (including no public float). Public float is measured as of the last business day of the issuer’s most recently completed second fiscal quarter. Annual revenues refer to the most recently completely fiscal year for which audited statements are available.

Compliance with Section 404(B) of the Sarbanes-Oxley Act (“SOX 404(B)”)

Along with the recent SRC amendment, only issuers qualifying as SRCs with annual revenue greater than $100 million are required to provide an auditor’s attestation of management’s assessment of internal control over financial reporting under SOX 404(b). Furthermore, entities that qualified as emerging growth companies under the Jumpstart Our Business Startups (“JOBS”) Act of 2012 and were exempt from SOX 404(b) for up to five years after going public may still benefit from the exemption if they have not reached $100 million in revenue.

Transition From SRC to Regular Filer

Once an issuer no longer qualifies as an SRC, measured as of the end of its most recently completed second fiscal quarter, the scaled disclosures are permitted through the issuer’s next annual report on Form 10-K. Note, however, that the filing deadline for the Form 10-K is based on the issuer’s filing status as of the end of the fiscal year covered by the Form 10-K.

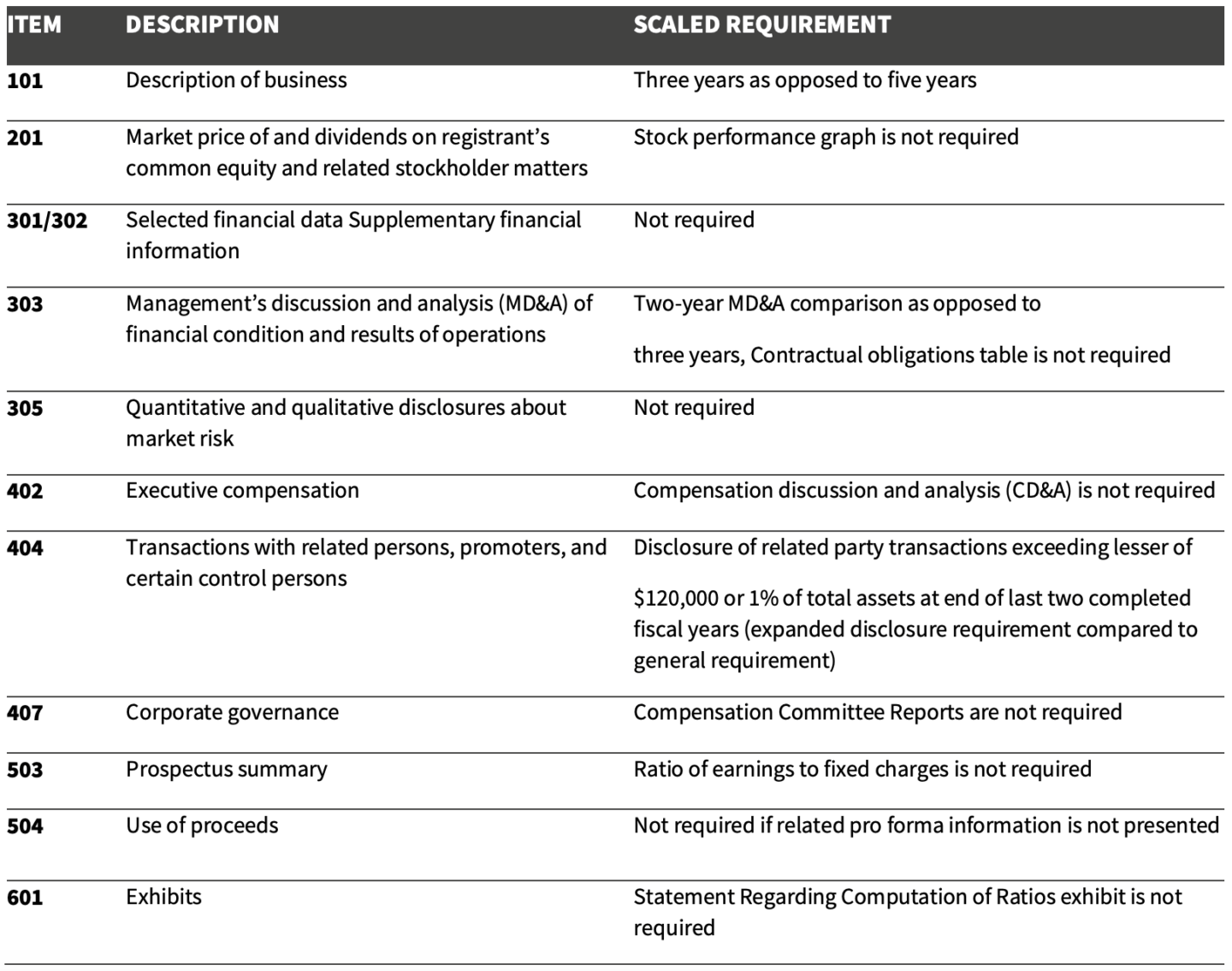

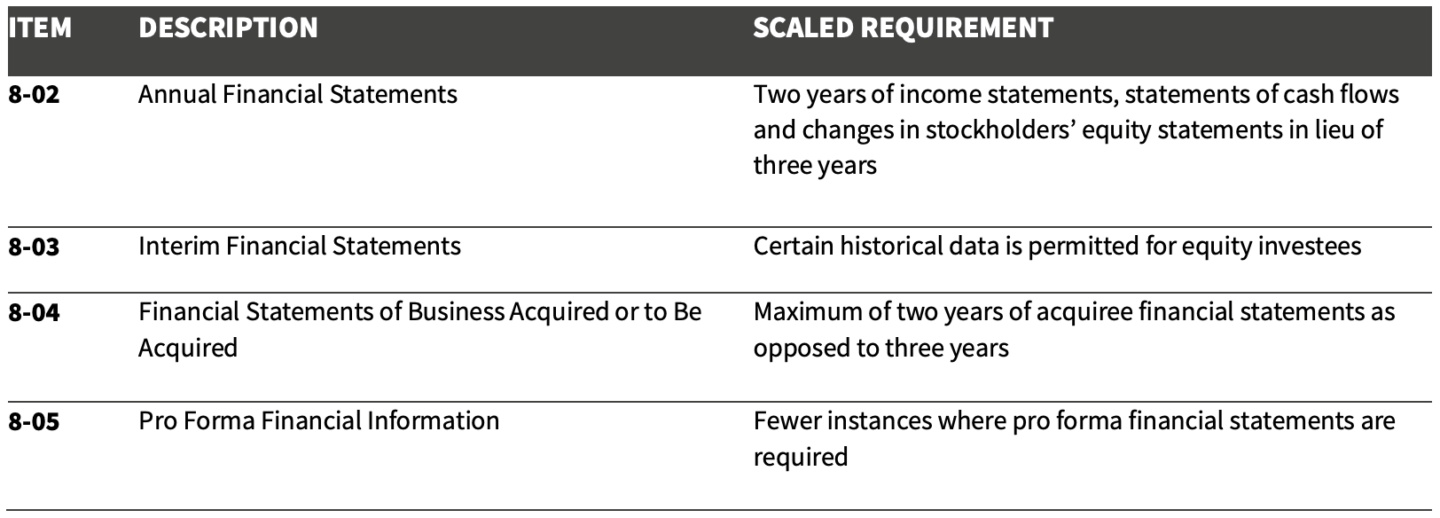

The more significant scaled disclosure requirements for SRC issuers are presented below.

Scaled Disclosure Requirements – Regulation S-K

Scaled Disclosure Requirements – Regulation S-X

The chart above does not highlight the most recently issued amendments or current proposed amendments by the SEC to the S-K disclosure requirements as part of the SEC’s effort to simplify and modernize disclosure requirements, many of which impact all issuers, regardless of filing status.

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 JFK Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree Street NE

Suite 1000

Atlanta, GA 30361

50 Milk Street

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

8310 South Valley Highway

3rd Floor

Englewood, CO 80112

1-855-CENTRI1

virtual@CentriConsulting.com