ASC 606 Implementation Services – Observations from Early and Standard Adopters

Details

The Financial Accounting Standards Board (“FASB”) issued ASC 606, Revenues from Contracts with Customers, in May 2014. ASC 606 took effect in 2018 for public entities with annual reporting periods beginning after December 15, 2017 and for non-public entities with annual reporting periods beginning after December 15, 2018.

ASC 606 impacts virtually all industries, including those that previously followed industry-specific guidance such as the real estate, construction, and software industries. For many entities, the timing, pattern of revenue recognition, and capitalization of certain costs change significantly under the new revenue standard. ASC 606 also introduces significantly enhanced disclosure requirements.

Of the approximately 4,000 public companies subject to U.S. Securities and Exchange Commission (“SEC”) oversight, only 32 were early adopters of the new revenue recognition standard – defined as adoption during 2017.

These early adopters ranged from large cap conglomerates to small cap niche companies. Stated reasons for early adoption vary greatly by registrant. Beyond wanting to demonstrate their ability to prepare for the complex transition to ASC 606, some companies disclosed other reasons including minimizing total transition and implementation costs.

15 of the 32 early adopters chose the full retrospective transition method, 10 the modified retrospective method, three did not use a transition method, and four did not disclose their transition method. Certain companies had no transition method because they had no previous revenue.

While nearly 50 percent of early adopters opted for the full retrospective transition method, as opposed to 31 percent that chose the modified retrospective, S&P 500 standard adopters have overwhelmingly chosen the modified retrospective method (approximately 88 percent). Possible reasons for this difference may include the time cushion afforded early adopters compared to their later adopting peers, and/or the relative size of the S&P 500 standard adopter companies, which makes implementation using the full retrospective method more challenging.

Throughout 2017, the SEC projected several areas of focus for review of ASC 606 in statements by various SEC Staff members. In a May 8, 2017 speech at the Bloomberg BNA Conference on Revenue Recognition, Sylvia E. Alicea, Professional Accounting Fellow of the SEC’s Office of Chief Accountant, discussed observations from the consultations between filers and her office during the previous 18-month period. These observations included:

- “The application of the principal and agent considerations for identifying the role of the reporting entity when another party is involved in a contract with a customer.”

- Identifying the contract – “Registrants should carefully assess the specific facts and circumstances of each transaction – including all relevant contractual terms – and exercise reasonable judgment when identifying and evaluating each contract with its customers.”

- Identifying performance obligations – “… will require a “fresh look” that begins with an evaluation of the contractual terms in its contracts with customers. Registrants may ultimately determine – as a result of their ‘fresh look’ – that there is no change in the unit of account … A company must support its identification of performance obligations according to the core principles in the standard – including whether the promised goods and services are inputs to a combined output … it’s critical that preparers understand the underlying transaction, including their specific facts and circumstances and contractual terms, and then faithfully apply the principles of the new revenue standard. This may require reasonable judgment, and in some cases, those judgments may necessitate changes to internal control over financial reporting.”

Of the 32 early adopters, the SEC issued revenue recognition-related comment letters to nearly one-third of them. These comments covered 18 different topics on 10-Q and 10-K filings made between January 1, 2017, and December 31, 2017.

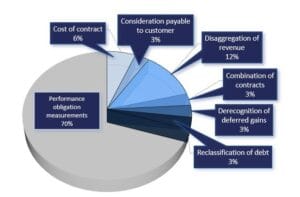

Most SEC comments were directed to the measurement of performance obligations. The distribution of SEC comment topics is depicted below.

The results seen in the disclosures of early adopters and the SEC comments directed toward them emphasize the complexity of ASC 606 and its extensive reach. Companies don’t have much time to rest after implementing ASC 606, as the implementation of the new lease accounting standard (ASC 842) is effective for public business entities for annual periods beginning after December 15, 2018 and interim periods therein, and for all other entities for annual periods beginning after December 15, 2019 and interim periods thereafter. The expected impact of ASC 842, Leases, is at least as (if not more) far-reaching than ASC 606.

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 JFK Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree Street NE

Suite 1000

Atlanta, GA 30361

50 Milk Street

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

8310 South Valley Highway

3rd Floor

Englewood, CO 80112

1-855-CENTRI1

virtual@CentriConsulting.com