M&A Advisory That Supports Your Success

When approaching acquisitions or a sale, companies must carefully evaluate each aspect of the transaction. It’s critically important to have your financial, operational, and strategic assumptions evaluated by an objective third party, who brings an outside perspective honed by years of experience in an array of industry specific deal scenarios.

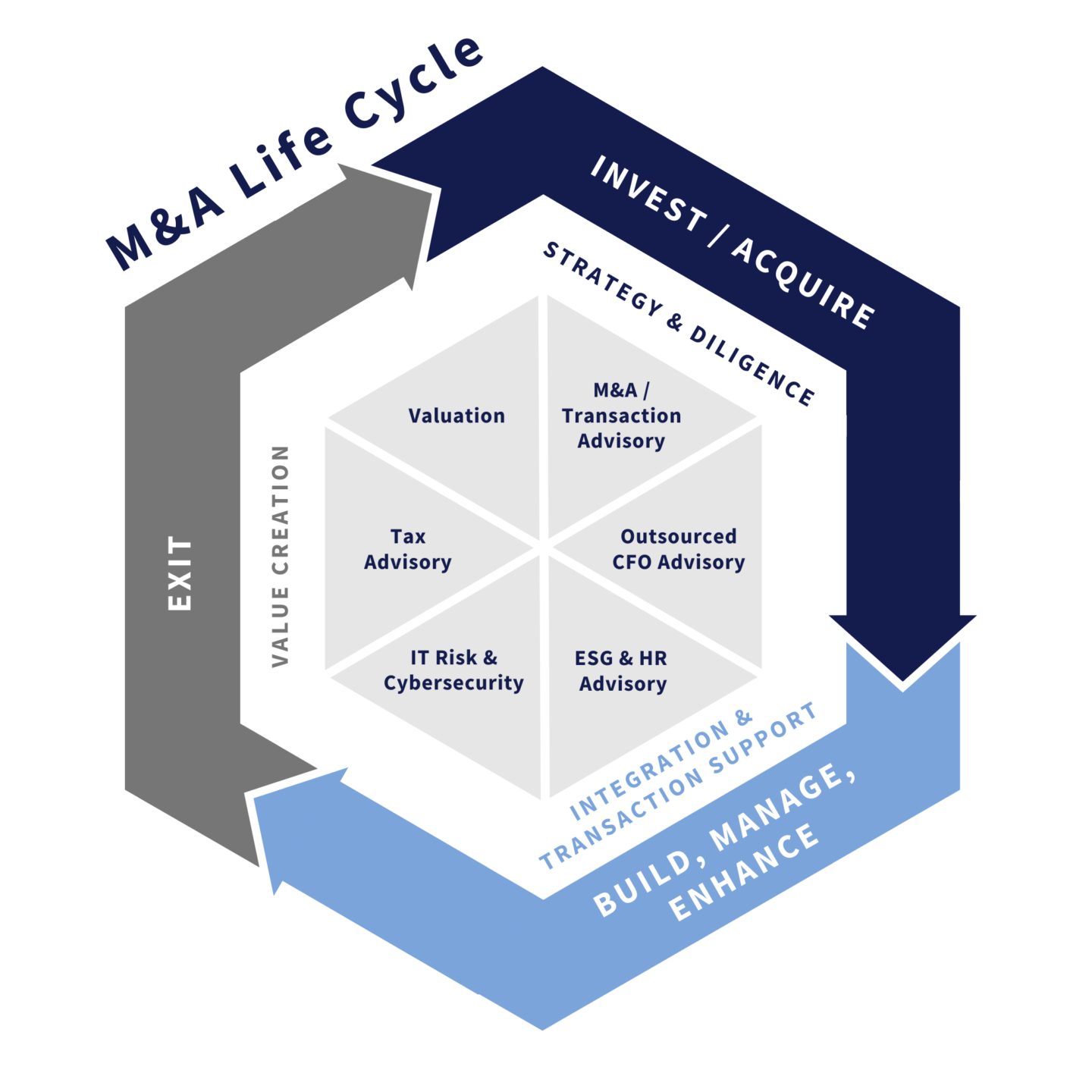

Centri’s M&A professionals have the insight and experience to drive significant value for private equity, venture capital, family offices, public companies, family-owned businesses, and other private company’s investors across all phases of the M&A lifecycle – from initial strategy, readiness, due diligence through execution and integration.

Our experts utilize their vast deal experience to provide a unique value measurement solution enabling our clients to achieve their goals through successful planning and execution of both buy-side and sell-side transactions.

Meet Our M&A Advisory Team

Centri’s team of experts is ready to help you with your M&A Advisory needs. You can learn more about our specialists on the One Team page.

Our Approach

Centri’s professionals offer a variety of M&A Advisory Services that will provide you with successful strategic planning, and execution, creating transformative value through the transaction lifecycle. These include:

- Collaborating with you to develop a strategy and legacy plan that meets the needs of your business and family goals.

- Working with you to determine potential growth opportunities, through the development of an acquisition strategy.

- Helping you evaluate potential merger or acquisition targets based on your growth objectives, providing valuation analysis and deal management solutions in order to optimize purchase price and transaction terms.

- Assessing the benefits and risks of each target through detailed financial analysis, financial due diligence, and forecasting.

- Conducting a thorough evaluation of your chosen target to ensure you get the most out of the transaction.

- Maximizing successful outcomes by developing a go-to-market strategy in preparation for a full or partial liquidity event.

- Optimizing marketability and exit value, accelerating the exit process, and identifying or mitigating risks that could adversely affect the valuation or salability of the business.

- Developing a sell-side readiness plan that enables management to spend more time executing against core business strategies and less time producing analysis for potential buyers.

- Offering best-in-class Transaction Advisory Services providing Buy-side and Sell-Side Financial Due Diligence to ensure you are well-equipped to close your deal with confidence.

Transaction Advisory & Specialized Acquisition Support

Many companies rely on Centri’s objective and comprehensive strategic and due diligence services to support their buy-side and sell-side activities. Whether you are a buyer or a seller, our integrated approach delivers a 360-degree perspective of the financial and operational aspects of your deal. Together with a hand-picked team of sector and deals specialists, we cover a comprehensive acquisitions due diligence process that turns questions into answers and data into insights.

Our integrated approach lets us address your needs across the entire transaction process working with your attorneys, investment bankers, and other advisors in order to identify and mitigate risks. Centri’s M&A Advisory Services address complex financial and post-transaction integration issues while completing transactions efficiently, protecting your interests, and instilling confidence in your investment.

Why Work With Centri?

Our team’s multi-layered skill set and experience with M&A work means we can guide you on the steps to take and help you prepare for both what you can expect and for the unexpected.

Need Our M&A Advisory / Transaction Advisory Services Consulting?

Please fill in the form to get in touch with our M&A advisory team and learn how we can help.

"*" indicates required fields

No matter what stage of the investment life cycle you’re in, our team can support you with timely advisory and responsive communication exactly when you need it. Our team can offer guidance to help your firm efficiently close deals, accelerate growth, create value, and achieve your investment return goals.

Our best-in-class transaction advisory services provide buy-side and sell-side financial due diligence to ensure you are well-equipped to close your deal with confidence. Together with a team of sector and deals specialists, we cover a comprehensive acquisitions due diligence process that turns questions into answers and data into insights. We also provide post-deal support and guidance, resolving accounting issues and managing audits.

Related Insights