Audit Readiness Checklist: Preparing For Your First External Audit

What Can You Expect From Your First Accounting Audit?

An external accounting audit is a means to review your company’s financial records to ensure they’re accurate and that no material misstatements are occurring. The final result of the process is a documented opinion that covers the state of your financial records, regulatory requirements, and internal controls.

Below, we’ve covered commonly asked questions about how to prepare for an external audit. We’ve also provided an audit readiness checklist you can download and use to start preparing.

Commonly Asked Accounting Audit Preparation Questions

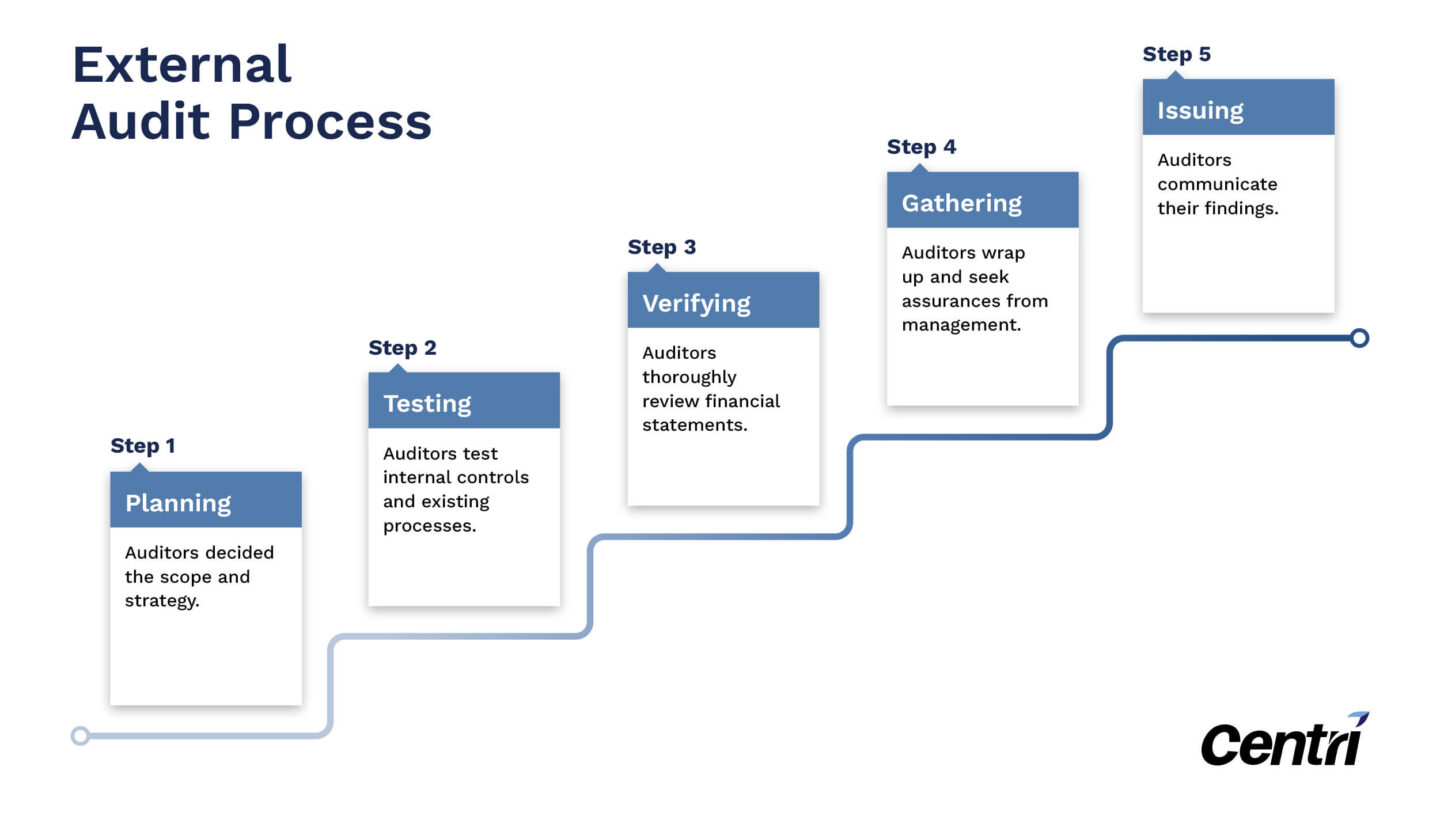

What’s the Step-By-Step Audit Process?

First, you’ll need to find a credible external auditing team. From there, you’ll sign an engagement letter with them and commence planning.

What’s the Value of an External Audit?

An external accounting audit gives financial assurance and peace of mind to your stakeholders. (They’re getting accurate information from an unbiased third party outside the business.) Additionally, it can protect you from incorrect operations that lead to larger consequences, like business closure, expensive penalties and fines, or even possible jail time for wrongdoing.

What’s the Final Outcome of an Accounting Audit?

In the reporting stage, you’ll receive 1 of 3 possible findings from your auditor.

Unqualified

Approval

The best rating you can achieve, this means your statements are fairly and accurately presented and compliant with GAAP principles, without any exceptions.

Qualified Approval with

Disclaimer

This means that most of your matters are being handled correctly, except for a few issues. (This happens if there’s a limitation of scope or a disagreement around the application of accounting policies. Your auditor will add a disclaimer about their inability to provide a ‘clean’ report.)

Adverse

Finding

This outcome means the financial information you’ve provided is out of alignment with the evidence and findings gathered in the audit. The truth of what’s occurring in your company is unfavorable, not in compliance, and needs corrective action.

How Can I Prepare for An External Audit?

Before starting the process, a little prep can go a long way. Consider finding a partner who has experience helping companies prep for an audit.

They’ll have a grasp of what your auditors will expect and be able to help ensure your team is ready to handle the audit on top of its regular responsibilities. Plus, an audit readiness partner can help you ensure the proper documentation and records are in place ahead of time.

Another key benefit of seeking this type of support prior to an audit is that it can ensure the process is smoother, and it reduces the pressure that undergoing one can place on your staff.

And in an age where executing human resources is challenging, the last upset you need is to lose valuable employees from burnout due to additional work. An audit readiness consultant can make sure your staff is prepared to take on extra asks from auditors on top of daily responsibilities.

Some of those areas of preparation that they can support include:

- Organizing documentation

- Reviewing internal controls

- Understanding the timeline and scope of your auditor

- Anticipating how to explain complex areas or non-routine methodology

Need help with audit preparation?

Explore our audit support services.

What Do I Need for a Financial Accounting Audit?

Simply put, you’ll need financial statements, documentation of internal controls, and specific records related to transactions. Below, we’ll get more into specifics with our audit readiness checklist.

Print Your Own Audit Readiness Checklist

Knowing what auditors look for is difficult if you’re new to the process. That’s why we’ve put together this checklist below to reference, so you can feel ready to get started. You can also download it for easy reference, complete with typeable fields.

Financial Documentation

- Financial statements

- General ledger with all transactions documented (covering fiscal year)

- Revenue and sales data

- Expense approvals

- Accrual accounts

- Trial balance

- Reconciliation and schedules supporting asset liability and equity accounts

- Bank notes, security agreements, and/or lease agreements

- Access to paid bills and checks

- Year-end payroll tax reports (Including W-2, W-3, and 1099s issued)

Internal Control Documentation

- Org charts

- Personnel manual

- Articles of incorporation or org bylaws

- Personnel manual

- Details showing the flow of transactions through your company

- Minutes of meetings with the board of directors

Other Relevant Information

- Major contracts with suppliers and/or customers

- Investment activities summary

- Schedule or upcoming fiscal year’s prepaid expenses

- Details of repairs and maintenance accounts

- Info on deposits that are in transit

True and Tested Advice About Preparing for Your Accounting Audit

Ultimately, the goal of the audit is to provide an accurate picture of your business so that you can continue moving forward. It’s natural to feel pressure around preparing for your first one, but remember to stay calm.

Take some time to seek out audit prep experts for help. Doing so can go a long way in alleviating stress for you and your team.

And before you start, take time to get acquainted with your auditor and ask:

- For a quick planning meeting to ensure you’re confident about what the process will entail and what’s required from you.

- A list of what they’ll need ready before arriving.

- If they have any other helpful resources you can use to get prepared.

From there, set apart time before the audit to work on cleaning up your internal records, accounting controls, and ensure you have proper and up-to-date documentation. Pay close attention to the most current accounting practices and standards to ensure your team is keeping pace with any major changes.

And finally, but most importantly, communicate with your internal team to set expectations, ensure their needs are met, and outline a timeline and responsibilities. Doing this will ensure your team feels ready and confident to undergo the process.

Looking for more support?

See how our experience can help you prepare for a smooth audit.

Partner | Accounting Operations and Transformation Practice Leader | CPA

Tori is a Partner at Centri Business Consulting and the leader of the firm’s Accounting Operations and Transformation Practice. With over 13 years of experience, Tori helps optimize and modernize clients' accounting functions to support scalable growth, operational efficiency, and audit readiness.. View Tori Jancovic's Full Bio

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

3 Logan Square

26th Floor

1717 Arch Street

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com

Index