Demystifying the IPO: When Does a Company Go Public?

Asking “when does a company go public” because you’ve got an interest in taking steps toward it yourself? At Centri, we’ve helped many businesses navigate the journey from private to public.

While every journey is unique to each company, we’ve put together helpful information on how you can prepare and answers to common questions we hear from private businesses like you. We’ve also provided a free downloadable IPO readiness checklist at the end of this blog for you to use as you get started.

Why Do Companies Go Public?

The simple answer is that going public gives your business access to more opportunities to increase its value. The initial IPO capital raising allows you to sell shares to the public, from which you can use the funds to fuel expansion, research, development, or debt payoff.

Some of the other benefits of an IPO include:

- Providing an exit strategy for VC partners or other investors.

- Making it easier for stockholders to sell stock.

- Increasing liquidity in your company.

- Using stock to acquire other assets or undergo a transaction.

- Boosting your credibility and reputation among customers, partners, and talent.

- Attracting and retaining employees with stock incentives.

What Are the Challenges of Going Public?

Deciding when you should go public is not a light decision. The process of preparing for an IPO (also called IPO readiness) comes with extra obligations, requiring dedicated time and money. Plus, your team will need to work toward meeting new financial reporting requirements, which can be hard to balance on top of daily operations. Getting ready means you’ll need to do extensive work on financial reporting, internal controls, corporate governance, and legal compliance.

If you successfully make it to your stock market debut, the work won’t end there.

There will be new regulations you need to follow as a public company that differ from what you adhered to as a private one. You’ll be liable if you’re not meeting the strict requirements outlined for public organizations.

Along with those regulatory changes, you’ll also lose some flexibility in managing company affairs, especially in situations where shareholders must approve action. You’ll also find more pressure to deliver consistent quarterly results and meet the expectations of the market. And because you’re a public company, key information (financial statements, disclosures on contracts, supplier info, etc.) will be available to everyone, including your competition.

Can a Company Go Private Again?

Yes, if a buyer acquires the majority of shares, it’s possible for a company to go private again. There are a handful of recognizable brands that have gone private after an IPO. However, shareholders have to agree to sell. And they’ll likely only sell at a higher amount above the market price of the shares.

This process to reverse course can be costly and challenging to navigate. That’s why it’s important to plan going public carefully and make sure it’s the best strategy for the goals your business wants to achieve.

So When Does a Company Go Public?

The short answer is that if you’ve got good fundamentals as a company, you’ll be prepared for going public. What does having good fundamentals mean?

It includes:

- Establishing compliance.

- Being ready with reporting to meet Sarbanes Oxley and other requirements.

- Building a good management team with experience to lead your stock market debut.

- Having a founder who is passionate and sees the vision with this strategy.

It’s easy to get trapped into thinking the volatility of the market has the most sway over your IPO market timing. But the truth is, there will always be interference around you. And our own CEO, Mike Aiello, who has decades of experience working with companies undergoing this journey, always likes to remind companies of how much opportunity there is in uncertainty.

In his experience, regardless of the narratives being told about the market, if you’ve done your preparation on what’s best for your company, you’ll find success. Hear more helpful advice to determine when it’s the right time to go public on the IPO Edge’s fireside chat with him.

Other Common FAQs About Going Public

How does a company go public?

You can do so through three methods.

- A traditional IPO: This is where you sell shares of common stock to investment banks (underwriters) who then resell them to investors on a stock exchange.

- A direct listing: This is where you list your shares on the stock exchange but don’t actually sell your own shares. All sales following your direct listing are done through existing stockholders.

- SPAC: This is where you raise capital through an IPO with the goal of buying a private company. The target acquired becomes public through a triangular merger and gets the SPAC’s original IPO capital in the transaction.

When can I go public?

Instead of focusing on when you should go public, first make sure you’re clear on why you’re going public. Having a strategic vision and putting the proper operations in place to meet that will ensure you’re ready when the time is right. And regardless of what the narrative is, remember Aiello’s advice.

There can be an opportunity in the midst of market uncertainties if you play the situation right. Make sure you know your industry and market well so you can build a credible case with underwriters and future investors.

What size does my company need to be to go public?

Instead of focusing on size or scale, focus on value. Work toward being able to demonstrate you have enough of it to attract investors after the issuing of stock. An IPO can be structured for a few million dollars. But if you’re targeting institutional investors and underwriters, something closer to $25,000,000 and upward will be more attractive.

How does going public work for startups?

If you’re a newer startup in a disruptive industry, you can still attract investors even if you have a short financial history. You’ll just need to show strong growth in sales or profits, and have a clear plan for growth that also can speak to what your competitive advantage is. Your patent portfolio and IP protection will also be crucial pieces. (As you want to demonstrate you have intellectual property with strong prospects.)

What’s the average time to an IPO?

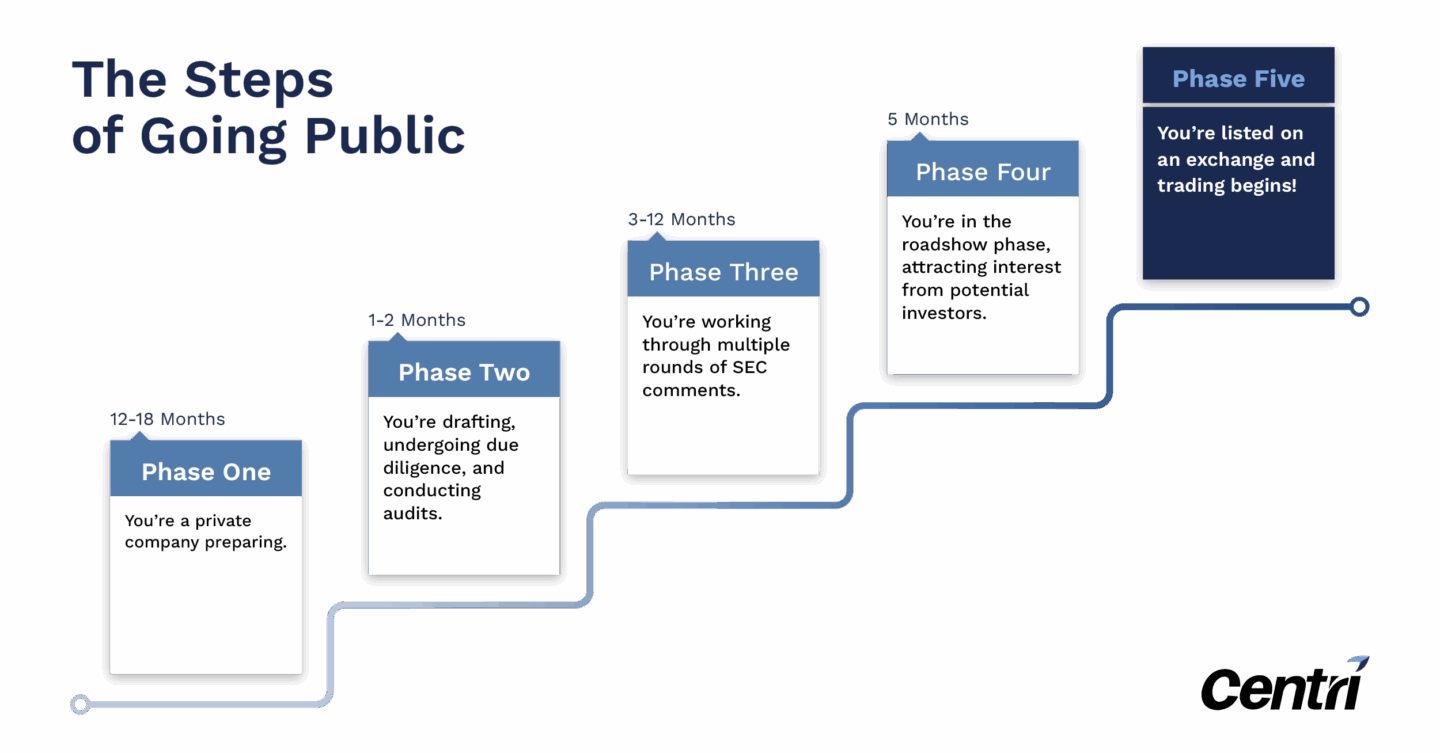

While it varies widely based on your unique circumstances, here’s a loose timeline of the average experience. In total, it can take anywhere from 33-39 months.

- 33-39 months before the IPO you’ll want to assemble a team of advisors who will be involved in your IPO process. (That includes your leadership team, underwriters, lawyers, CPAs, and SEC experts who can help with audit readiness services.)

- 3-6 months before the IPO you’ll need to file your registration statement with the SEC and start doing due diligence.

- 1-3 months before the IPO you’ll need to market it to investors and fuel interest in shares through the IPO roadshow.

Still have more questions? Here’s a great resource from the SEC with more information.

IPO Readiness Checklist: Advice for Getting Started

If you want to increase your IPO success factors, don’t wait to put the right steps in place to get you there, even if it’s a far-off goal. IPO readiness can prepare you so that when the time comes to work toward a stock market debut, your team is ready to rise to the challenge.

If going public is a goal, we recommend that you begin getting ready now. Doing so will alleviate the pressure on your team as you get closer. Especially because you’ll need to balance both working toward your IPO and daily operations.

Thinking about when it’s the right time to go public for your company? See how Centri’s IPO readiness team can help you plan and prepare to increase the chances of your success.

Partner | SEC, Financial Reporting & SPAC Practice Leader | CPA

Derek is a Partner at Centri Business Consulting and the leader of the firm’s SEC, Financial Reporting, & SPAC Practice. He has more than 23 years of accounting experience in both public and private industries. View Derek Kearns's Full Bio

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

3 Logan Square

26th Floor

1717 Arch Street

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com

Index