Financial Statements of Acquired Businesses

This guide provides a high-level summary of the SEC’s financial statement requirements for significant business acquisitions and is based on the SEC’s latest rule amendments that become effective on January 1, 2021 but may be voluntarily applied earlier.

Where to Start

When evaluating the financial reporting ramifications for an acquisition, companies should begin by answering the two following questions:

- Is the company acquiring a “business,” as defined by Regulation S-X?

- What is the significance of the acquired business to the registrant?

The answers to these questions will ultimately drive the financial statements to be filed in Form 8-K and any subsequently filed registration statements.

Is the Acquisition a “Business”?

Regulation S-X Rule 11-01(d)

There is a presumption that a legal entity, subsidiary, or a division is a business, though a lesser component of an entity may also constitute a business and will generally depend on whether the nature of the revenue-producing activity is the same before and after the acquisition (among other factors).

Is the Acquired Business “Significant”?

Regulation S-X Rules 3-05 and 1-02(w)

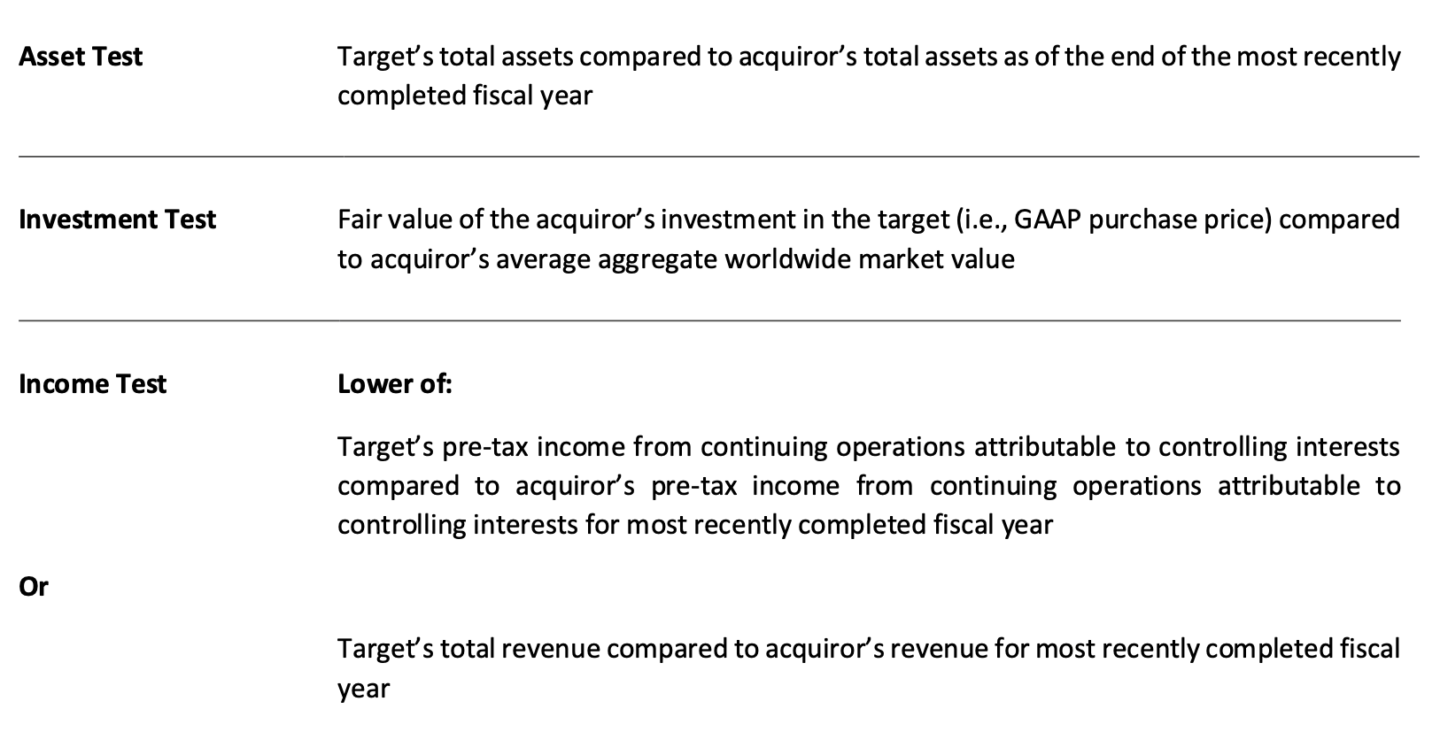

The significance of an acquired business (“target”) to the registrant (“acquiror”) is based on three tests, and the highest percentage of the three tests is used to determine the financial reporting requirements.

Additionally, a registrant is permitted to use pro forma financial information to measure significance for acquisitions completed after the latest fiscal year-end if the registrant has filed:

- The required target financial statements, and

- The required Article 11 pro forma financial information for any such acquired business.

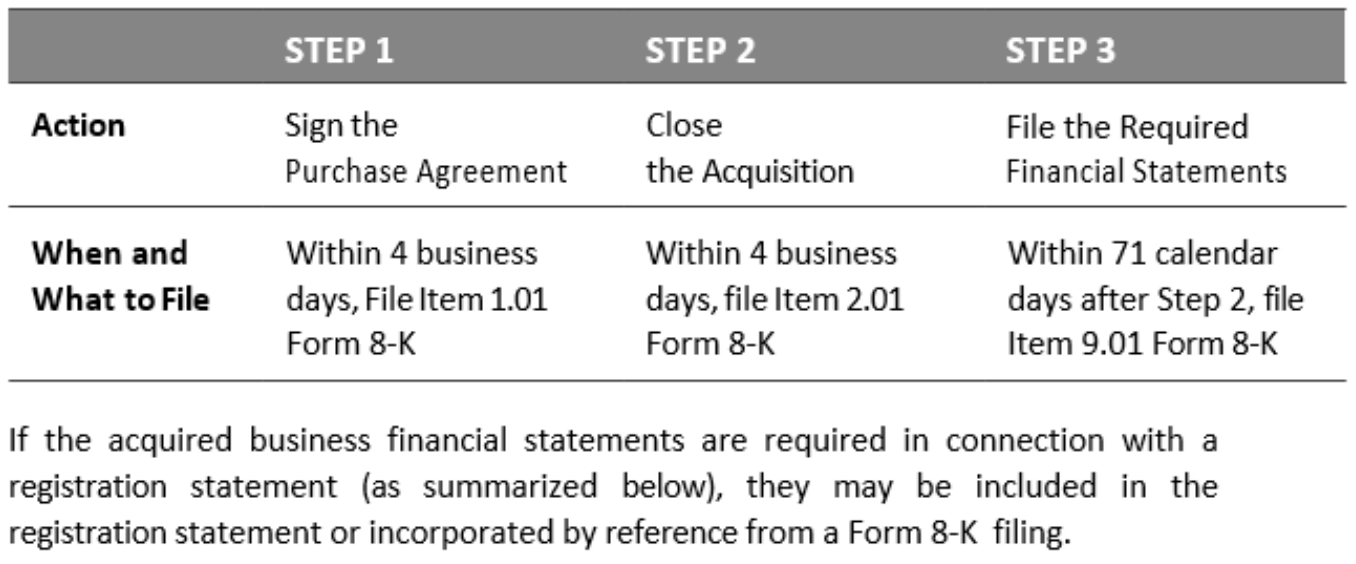

When to Report a Significant Acquired Business

Financial Statements of an Acquired Business in Form 8-K

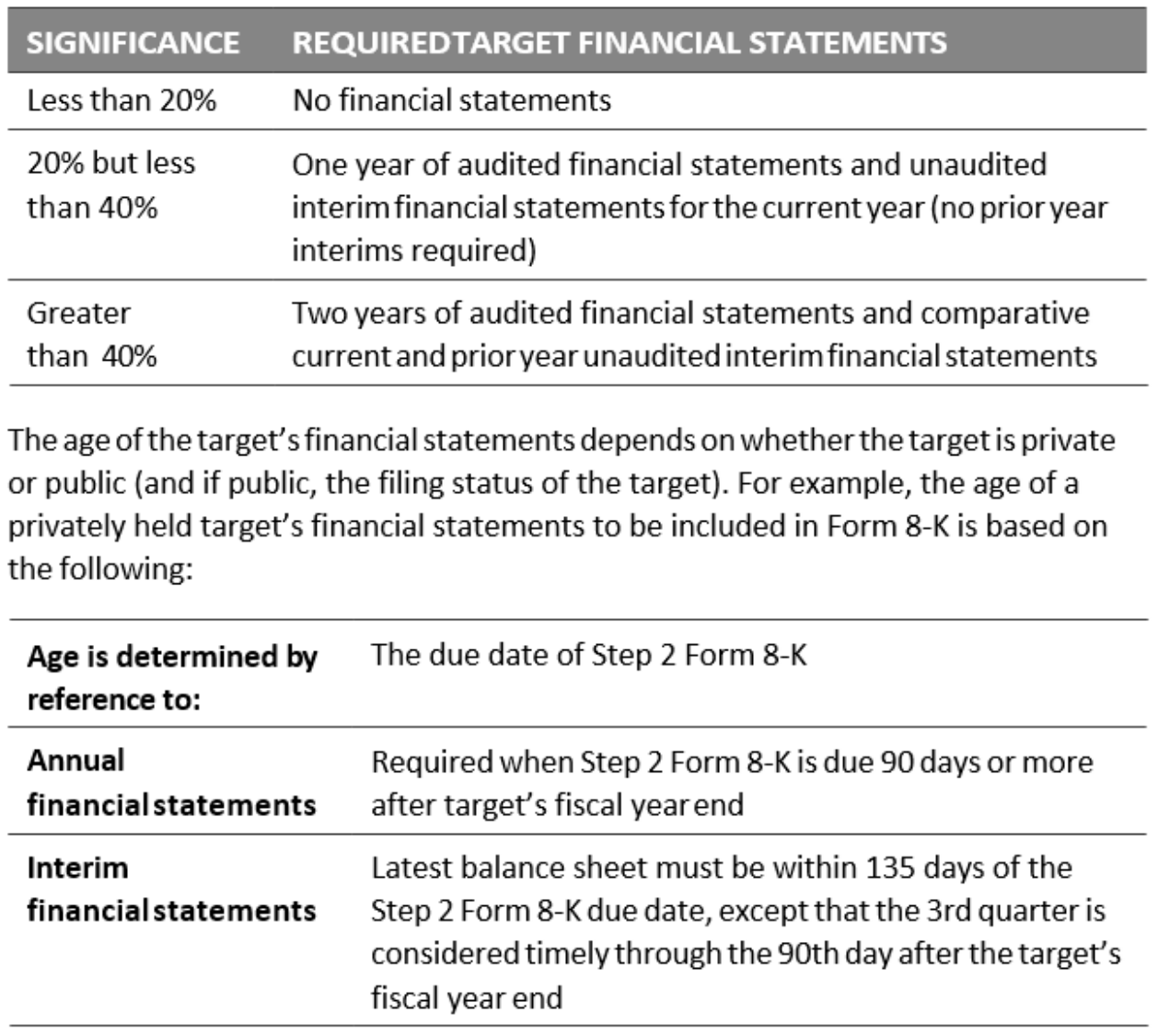

The historical financial statement requirements for the target to be filed in Form 8-K are based on bright-line significance thresholds set forth in S-X Rule 3-05 as follows:

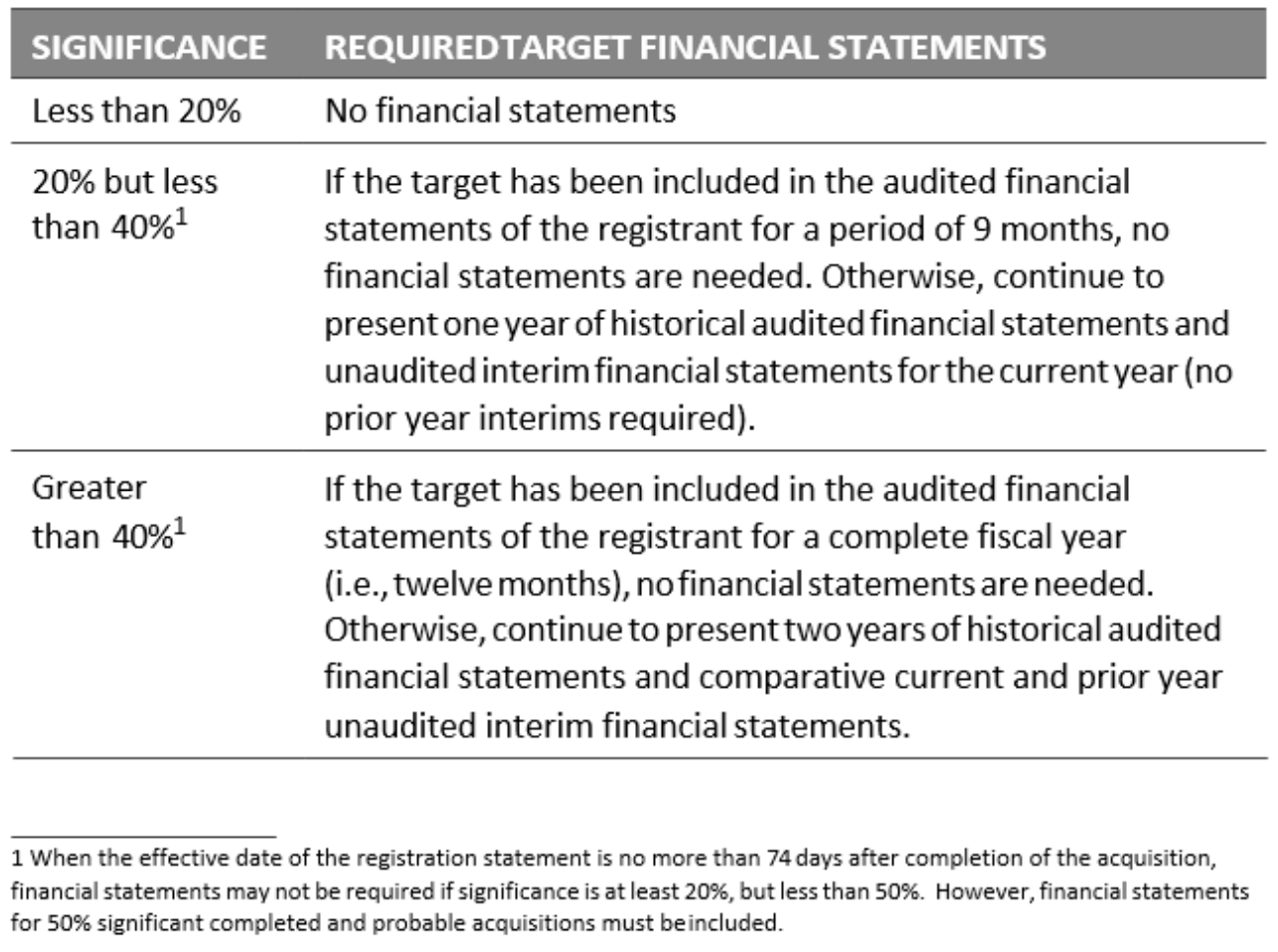

Financial Statements of an Acquired Business in a Registration Statement

Registrants also need to consider the aggregate effect of all business acquisitions that have been completed or are probable since the date of the most recent audited balance sheet filed for the registrant. If the aggregate effect of such acquisitions exceeds 50% significance for the asset, investment or income tests, registrants are required to file:

- Pre-acquisition historical audited financial statements for any target whose individual significance exceeds 20%; and

- Pro forma financial information depicting the aggregate effects of all such “individually insignificant businesses” in all material respects.

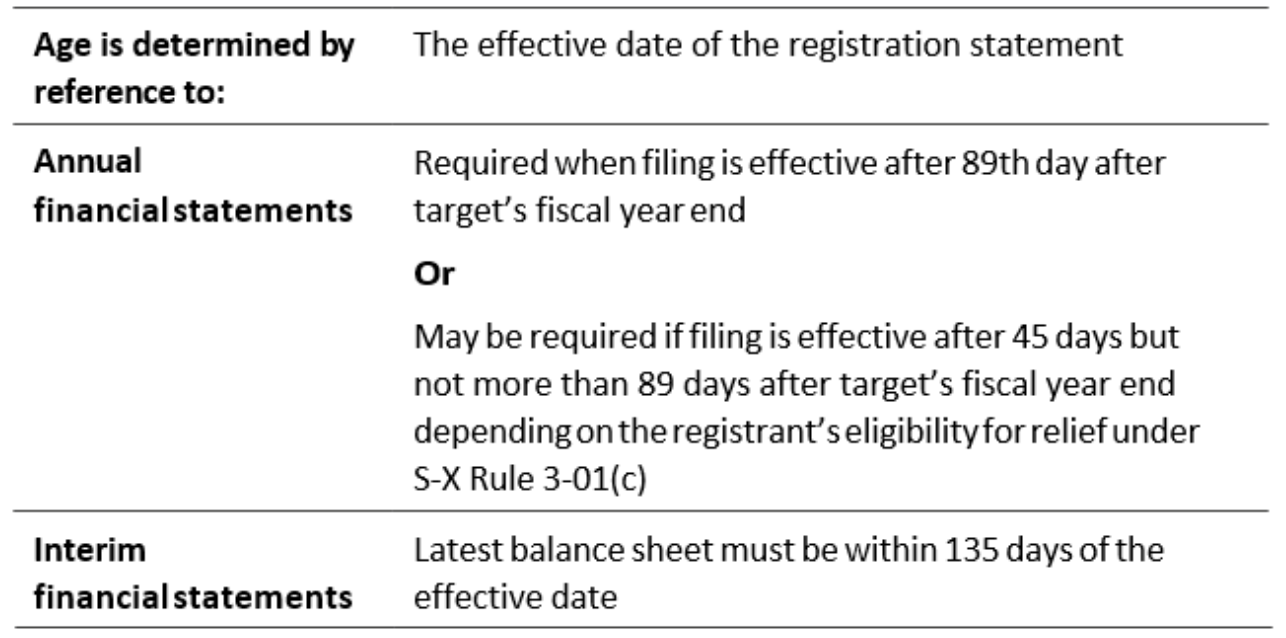

The ages of the annual and interim financial statements for a privately held target in a registration statement are as follows:

Pro Forma Financial Information

Regulation S-X Article 11

When a target’s historical financial statements are required to be presented, pro forma financial information must also be presented that includes:

- A pro forma condensed balance sheet as of the end of the most recent period for which a balance sheet is required;

- Pro forma condensed statements of income from continuing operations for the last completed fiscal year and year-to-date interim period; and

- Accompanying explanatory notes.

Pro forma adjustments are required to give effect to the accounting for the acquisition. Additional management adjustments to reflect synergies and dis-synergies of the acquisition are optional and may be presented in the explanatory notes.

Internal Control Considerations

Business combinations such as acquisitions that are deemed “significant” to the acquirer can be complex and may require a significant amount of effort to design new controls or integrate into existing processes and internal control structure. Maintaining and implementing effective internal controls is one of management’s most important responsibilities and a requirement per the SEC rules for public filers on Item 9A of the 10-K and Item 4 on the 10Q’s.

One of the first steps when contemplating the appropriate controls for a significant acquisition is to identify all risks that present a reasonable possibility of a material misstatement related to the acquisition. The nature and level of risk of material misstatement may vary from acquisition to acquisition. From an internal control standpoint, the acquiring company should consider internal controls addressing specific risks related to the acquisition. Some examples specific to accounting and financial reporting include:

- Valuation of assets acquired, and liabilities assumed (Purchase Price Allocation process), including intangibles

- Consolidations

- Manual journal entries

- Measurement period adjustments

- Accounting policy alignment

- Chart of Account mapping for General Ledger (G/L) accounts

- Disclosures

It is important to document the valuation approach (e.g. income, market, cost), legal considerations, tax matters, and related assumptions used in the evaluation of target’s financial statements and pro forma financials. Data integrity (accuracy, completeness), and reliability of the information being evaluated needs to be scrutinized. The internal deal team and third-party evaluators also play an important role to ensure due diligence is performed, reviewed, and presented to the Board for consideration. It is critical to evaluate post-acquisition integration costs related to people, process and technology. This will ensure that these costs are not overly burdensome and do not impact the synergies or cost savings that the acquirer may be expecting to align with their strategic goals. Therefore, internal controls in evaluation, accounting and disclosures for significant acquisitions are important both from pre- and post-acquisition.

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com