SEC Climate Disclosure Final Rules: Key Requirements for SEC Filers

Background

The importance of climate-related disclosures for investors has grown as investors, companies, and the markets have recognized that climate-related risks can affect a company’s business and its current and longer-term financial performance and position. On March 6, 2024, in a 3-2 vote along party lines, the U.S. Securities and Exchange Commission (SEC) adopted the long-awaited final rules that will require disclosures about climate-related risks that are reasonably likely to have a material impact on a company’s business strategy, results of operations, or financial condition. The proposed rules faced intense public scrutiny over the last two years, with the SEC receiving more than 24,000 comment letters. The final rule, “The Enhancement and Standardization of Climate-Related Disclosures,” becomes effective 60 days after being published in the Federal Register. The final rules differ in several respects from the initial proposal, most significantly in changes to the financial statement footnote disclosures and reductions to the scope of and number of registrants subject to the greenhouse gas emissions (GHG) disclosures.

Key Requirements

The final rules are required for nearly all SEC registrants, including all U.S. registrants, foreign private issuers, and companies filing registration statements, including IPOs.

General Disclosure Requirements

- Actual and potential material impacts of climate-related physical and transition risks on the registrant’s strategy, business model, and outlook.

- Processes for identifying, assessing, and managing climate-related risks and whether and how climate-related risks are integrated into the company’s overall risk management processes.

- Any transition plans to manage and mitigate material transition risks that are part of the company’s risk management strategy.

- Information about the registrant’s board of directors’ oversight of climate-related risks.

- Management’s role in assessing and managing material climate-related risks.

- Information on any climate-related targets or goals that are material to the registrant’s business, results of operations, or financial condition, including specific quantitative and qualitative disclosures regarding material expenditures and material impacts on financial estimates and assumptions.

Greenhouse Gas Emissions (GHG) Disclosure Requirements

- Disclosures of Scope 1 and/or Scope 2 greenhouse gas (GHG) emissions for large accelerated and accelerated filers on a phased-in basis when those emissions are material.

- Emerging growth companies (EGCs) and smaller reporting companies (SRCs) are exempt from emissions disclosures.

- The method used to determine its organizational boundary as well as any material differences from the registrant’s consolidated financial statements.

- “Protocol or standard” used to report GHG emissions, including information about the methodology, significant inputs, and significant assumptions used to calculate GHG emissions (such as Greenhouse Gas Protocol).

- Filing an attestation report covering the required disclosure of such registrants’ Scope 1 and/or Scope 2 emissions on a phased-in basis.

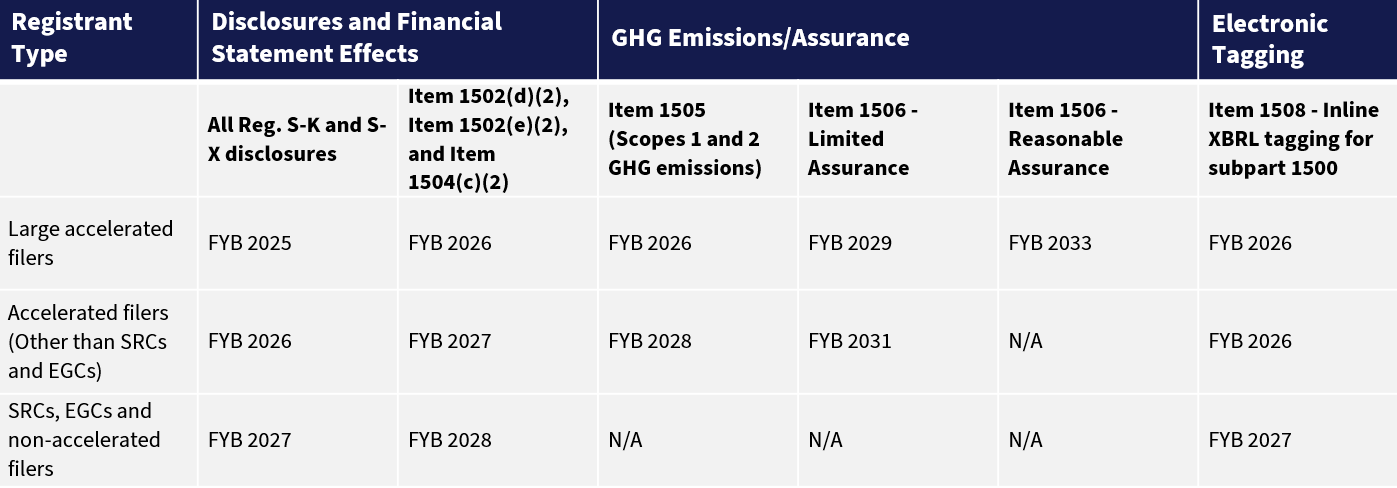

The final rules include a phased-in compliance period for all registrants, with the compliance date dependent on the registrant’s filer status and the content of the disclosure.

Financial Statement Disclosure Requirements

- Separate disclosure is required of the impacts from severe weather events and other natural conditions relating to (1) capitalized costs and charges and (2) expenditures expensed as incurred and losses. Any recoveries related to these amounts must also be disclosed.

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements.

- The disclosure of capitalized costs and charges is required only if the absolute value of the aggregated impact is 1% or more of the absolute value of the stockholder’s equity or deficit as of the end of the relevant fiscal year, subject to a $500,000 de minimis threshold

- The disclosure of expenditures and losses is required if the aggregated impact is 1% or more of the absolute value of income or loss before taxes for the relevant fiscal year, subject to a $100,000 de minimis threshold.

- The rule clarifies that if the severe weather event or other natural condition is a significant contributing factor in incurring an expenditure, loss, capitalized cost, charge, or recovery, the entire amount must be included in the disclosure, with separate disclosure of where amounts are presented in the financial statements.

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements.

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs), if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements.

- The rules require qualitative disclosures regarding financial estimates and assumptions materially impacted by (1) severe weather events and other natural conditions or (2) disclosed targets or transition plans.

Presentation of the Disclosures

The rules will require disclosures in registration statements and periodic reports, such as Form 10-K for domestic issuers and Form 20-F for foreign private issuers. Disclosures will be required prospectively, with information for prior periods required only to the extent it was previously disclosed in an SEC filing. These disclosures can be either in a separate, appropriately captioned section of its registration statement or annual report or in another appropriate section of the filing, such as Risk Factors, Description of Business, or Management’s Discussion and Analysis, or, alternatively, by incorporating such disclosure by reference from another Commission filing as long as the disclosure meets the electronic tagging requirements of the final rules.

The final rules leverage some concepts from the disclosure framework developed by the Task Force on Climate-related Financial Disclosures (TCFD), which is also the basis of other new mandatory reporting requirements in the US and globally.

Applicability and Dates

Compliance Dates Under the Final Rules

Source: www.sec.gov

- As used in this chart, “FYB” refers to any fiscal year beginning in the calendar year listed.

- Financial statement disclosures under Article 14 will be required to be tagged in accordance with existing rules pertaining to the tagging of financial statements. See Rule 405(b)(1)(i) of Regulation S-T.

How Centri Can Help

The key to your company’s success in meeting the final disclosure rules will be to develop a plan, educate your organization on the requirements, applicability, perform a readiness assessment, and implement the right processes and controls for data reporting. The ability to break down silos and work collaboratively across functions will be critical to the success of effectively complying with the final ruling. If you’re a board member, head of sustainability, or finance personnel in charge of ESG and sustainable initiatives at your company, Centri’s team of experts can help prepare your company in these areas. Contact us to learn how we can guide you to confidently move forward with your sustainability journey and compliance with the SEC rules.

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com