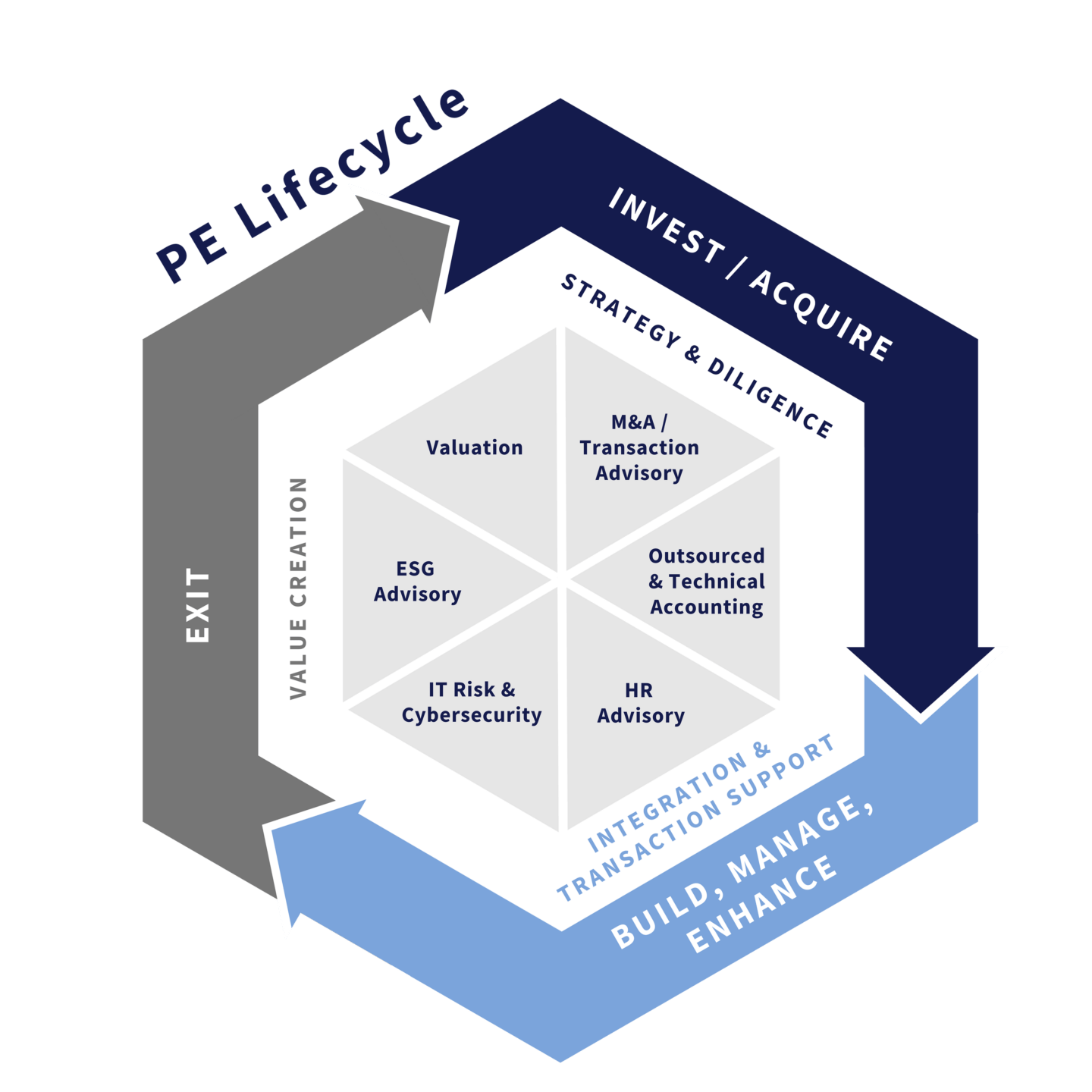

Lifecycle of a Private Equity Investment

Although every deal is different, the life cycle for most private equity (“PE”) investments follows a similar path: (i) invest/acquire (ii) build, manage, enhance; and (iii) exit. Value can be gained or lost at every stage of the investment, so employing the appropriate expertise and advisors throughout the life cycle of an investment is vital to maximizing the marketability of the investment and the return for the fund’s investors.

Invest/Acquire

Target Identification/Screening – Potential target companies can come from many different sources: in-house research, company presentations at conferences, sell-side investment banks, M&A attorneys, direct pitches from the target, sourcing platforms, existing portfolio companies, and other private equity firms. Regardless of the source, the importance of securing strategically best-fit investments, optimizing purchase price and terms through negotiating insights, and accelerating transaction speed to close without compromising thorough planning for Day One is paramount.

Due Diligence – Once a promising target is identified, the fund’s investment team must ensure that it truly is the right strategic fit and value proposition for the fund. This is accomplished through the due diligence process, which effectively quantifies the risks, costs, and opportunities associated with a business transition. Financial due diligence, or quality of earnings, and tax due diligence are the most commonly performed analysis. While there’s no doubt that a clear understanding of the target’s financials is vital to a successful investment, human capital due diligence and information technology (“IT”) (or cyber) due diligence are also crucial for maximizing value because the most thoughtful projections are meaningless if the target lacks the personnel, systems, technology, and security to implement them. It is important to identify and mitigate risks, accelerate transition timelines, and minimize cost variability to ensure the transaction priorities and investment thesis are achieved.

Deal Structuring – The time and resources invested in due diligence can be to no avail if the transaction isn’t structured correctly. Deal structure will determine how the transaction generates value for all stakeholders and should consider the risks that could affect the closing of the deal as well as issues that may arise in the future.

Closing – Signing the final agreement, transferring the consideration, and issuing the press releases are cause for celebration; however, they are only the start of the closing process. In addition to addressing any human capital and IT needs/issues identified in due diligence, the acquirer begins the sometimes-lengthy purchase accounting process. Although the depth and complexity will vary based on the legal structure and size of the transaction, every transaction will have immediate financial statement implications that need to be properly accounted for and documented. Ahead of closing, a 100-day plan which outlines the most urgent value-creation steps that should be taken as soon as the deal closes should be developed. The objective of the 100-day plan is to identify key value drivers and create a roadmap to make improvements in those areas specifically identified.

Build, Manage, and Enhance

Value Creation through Operations Optimization – During the hold period, which typically lasts 3-7 years, the acquirer creates value by driving process transformation, optimizing operations, and maximizing the financial performance of the portfolio company before positioning the business for an exit. In this stage, PE firms leverage their experience and networks to refine the acquired company’s strategy and grow EBITDA through improved risk controls, functional processes, operational infrastructure, and human capital development. To paraphrase Henry Kravis, any idiot can buy a business, it’s what happens afterward that really matters.

Exit Planning

Exit – Whether it be through a trade sale, secondary buy-out, or IPO, the exit is where most of the investment return is generated. The proper timing and structure for the exit are vital to maximizing the return. Success is formed from target identification and refined throughout the life cycle of the investment. Every stage of the investment should build toward a well-developed, well-supported narrative of why the company represents a value proposition to its next owners. Similar to the invest/acquire stage, due diligence is strongly recommended in order to properly prepare for an exit. Performing sell-side financial due diligence allows the seller to identify potential issues ahead of a buyer and set the narrative while also establishing a view of adjusted EBITDA for the most recent twelve-month period. This puts the seller in a stronger position when it comes to setting the enterprise value.

How Centri Can Help

Our experienced private equity advisory team provides the support you need at every stage — from pre-close to the first 100 days and post-acquisition integration, through to exit planning and execution. We provide customized and timely service and responsive communication exactly when you need it most, so your firm can efficiently close deals that are profitable and create value. Contact us to learn more.

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com