Main Street Lending Program

As Congress continues to evaluate additional spending to help small and mid-size businesses, it is important to remember there are still funds available from the CARES Act. Earlier this year, the Federal Reserve Bank of Boston (“FRBB” or “Fed”) announced that the Main Street Lending Program (“MSLP”) was OPEN for lender registration, to support lending to medium-sized businesses and nonprofit organizations that were in sound financial condition prior to the onset of the COVID-19 pandemic. The program has approximately $600 billion to disburse and last week the first lenders made the funding available to eligible applicants. Compared to the typical commercial loan, a Main Street loan includes several unique terms, eligibility requirements, certifications, and covenants that will need to be evaluated prior to working with a lender.

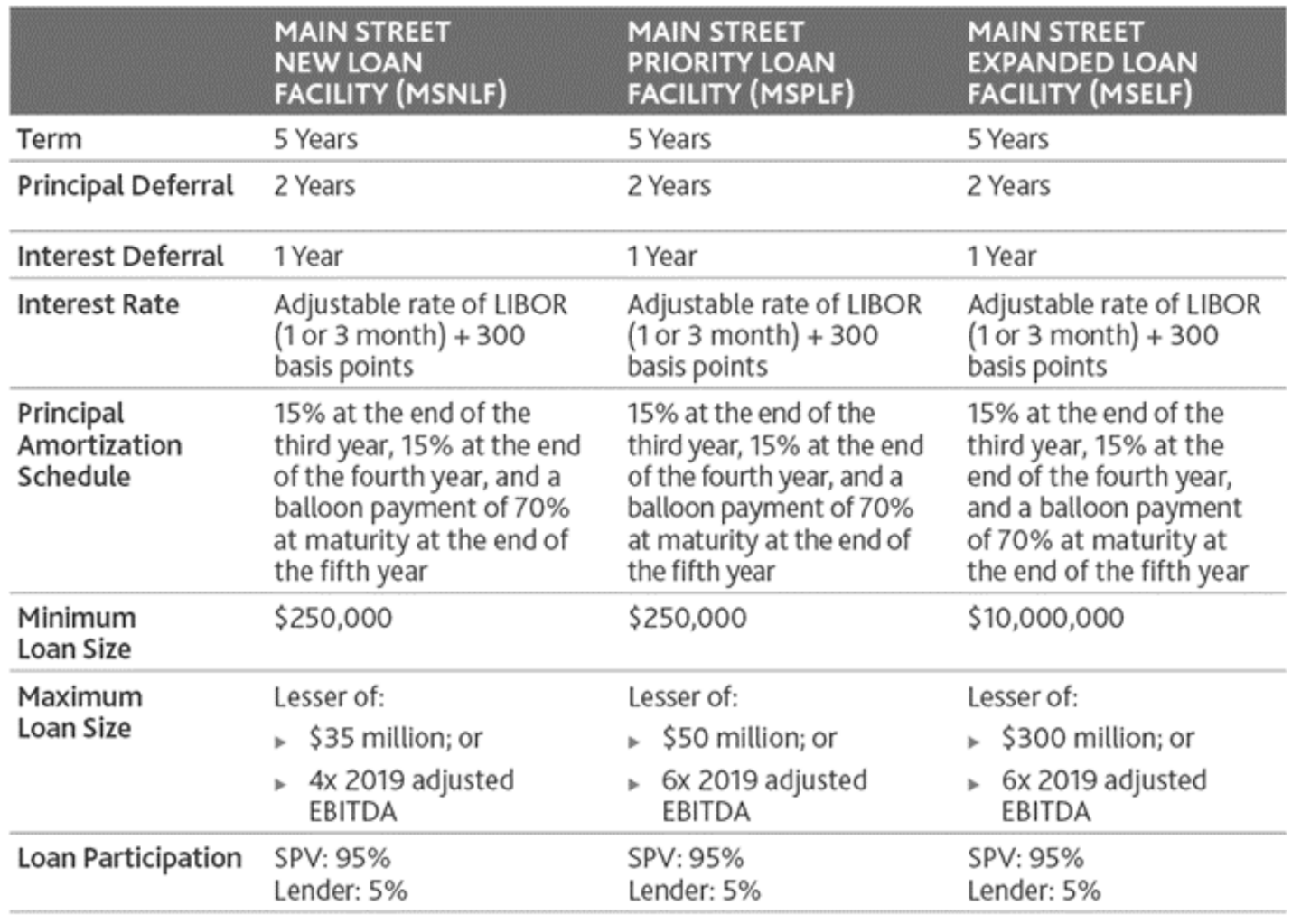

Here are some of the key provisions:

Key Eligibility Criteria and Loan Details

Factors to Consider Prior to Applying

- Prior to applying for the MSLP, you should take into consideration the capital needs of your business. Forecasting your capital needs as they relate to lost revenue, payroll, and operating liquidity needs is essential to determining whether this loan will be an attractive source of capital for your business.

- Ensure that you have maximized the usage of Paycheck Protection Program dollars.

- Understand your current debt agreements and how obtaining additional debt might impact your debt covenants. There may be limitation provisions in your current debt agreements which may impact what you will be able to borrow from the Main Street Loan program.

- Seek better terms from your current creditors. Before seeking new debt, you may be able to negotiate better terms with your current lender for existing debt.

- Lastly, the Main Street Loan program puts limitations on executive compensation, prohibits payment of dividends, and the buy-back of stock. These restrictions may make this form of debt less attractive.

How to Apply for a Main Street Loan

A Main Street loan application is to be made at a federally insured lending institution, which will apply its own underwriting criteria. In addition, the Federal Reserve also released several application forms and agreements that will be completed by the lender and signed by the borrower in conjunction with the primary loan application. The documents include borrower certifications and covenants.

The Federal Reserve cautions that “eligible borrowers should contact an eligible lender for more information on whether the eligible lender plans to participate in the program and to request more information on the application process.”

Please refer to the Federal Reserve’s Main Street website for the latest program information

MSLP’s Expansion for Nonprofit Organizations

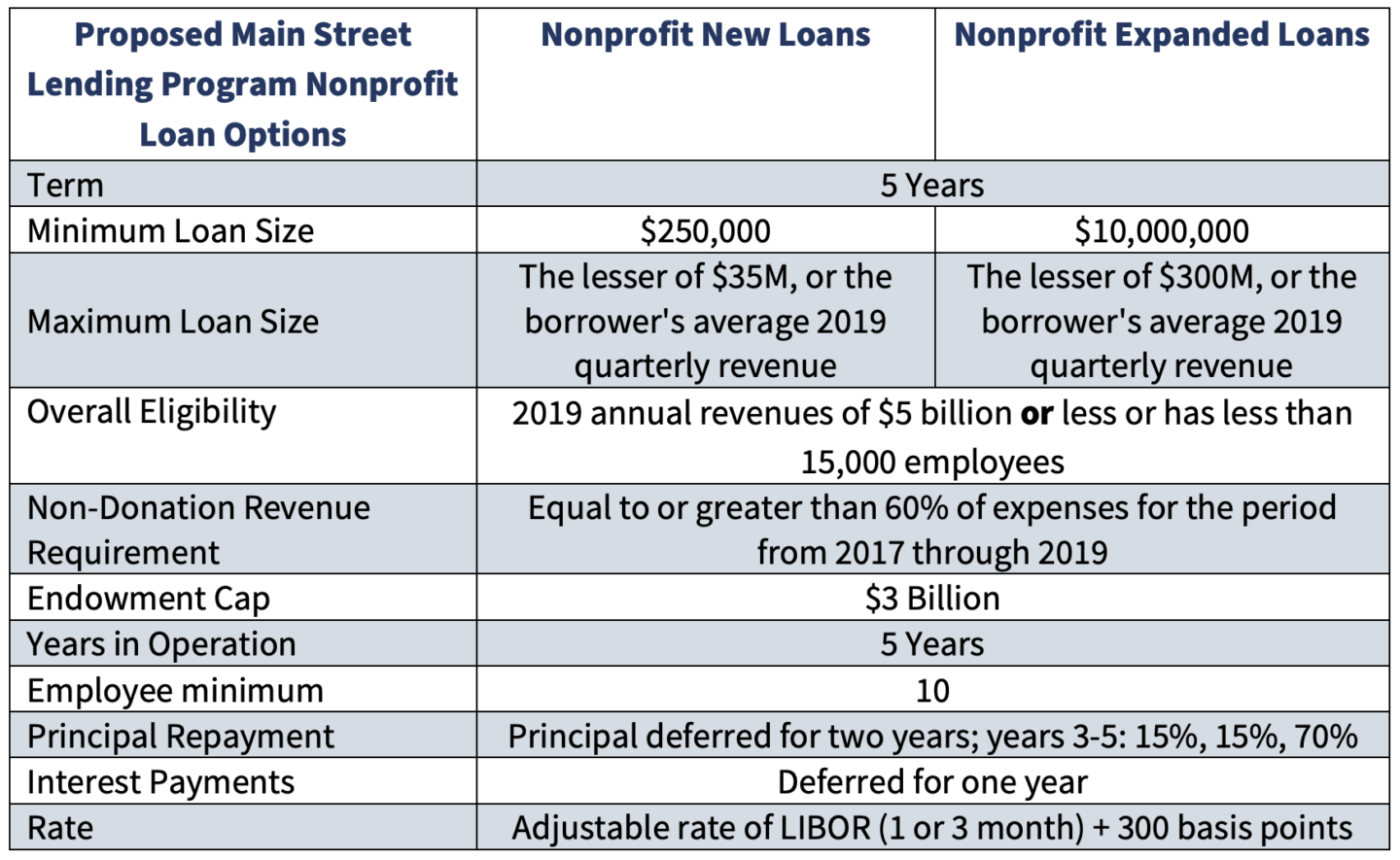

On July 17th, the Fed announced two additional MSLP loan facilities specifically targeted at the nonprofit industry. The new facilities substitute revenue for EBITDA in the leverage calculation. Amortization, interest rate and lender participation remain consistent with the commercial Main Street facilities. Please note the application process will be made available once these new loan facilities are operational.

Below is a summary of key nonprofit loan terms.

The Fed is consistently making updates to the MSLP term sheets in order to make the loans more accessible to the borrowers through expanded eligibility. Below are key takeaways from the FAQs published June 8th and expanded upon during the June 15th FRBB Q&A Session for Borrowers:

Pari Passu (Seniority & Collateral)

The Fed is consistently making updates to the MSLP term sheets in order to make the loans more accessible to the borrowers through expanded eligibility. Below are key takeaways from the FAQ’s published June 8th and expanded upon during the June 15th FRBB Q&A Session for Borrowers:

MSNLF may not be subordinate to any other debt instrument.

MSPLF and MSELF may not be subordinate to any other debt instrument except for mortgage & equipment debt (secured by real property and/or equipment).

More complex seniority rules exist if the existing debt has a collateral position.

Loan Maximum Calculation

Existing debt instruments refinanced at the time of loan origination with the MSPLF should be excluded from the leverage calculation in determining the maximum loan amount.

Refinance Prior to MSLP

Once established, non-MSLP debt cannot be pre-paid with MSLP funds unless the existing loan agreement mandates those payments in the normal course of business.

It is permissible to restructure existing debt prior to establishing a Main Street Loan facility thus causing a revised amortization schedule and allowing contractual payments with MSLP funds.

Updated details on the MSLP are available via term sheets provided by the Fed:

- Main Street New Loan Facility

- Main Street Priority Loan Facility

- Main Street Expanded Loan Facility

- Nonprofit Organization New Loan Facility (NONLF) Term Sheet

- Nonprofit Organization Expanded Loan Facility (NOELF) Term Sheet

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com