Structuring the Sale of an S Corporation: What All Parties Should be Considering from a Tax Perspective

When thinking about how to structure the sale of a business, it is well known that buyers typically prefer to buy assets and sellers prefer stock[1] sales. There are a variety of reasons for these preferences, including taxes. Depending on how a target company is classified for US federal and state income tax purposes, there may be flexibility in structuring a deal that would allow it to be considered a sale of stock for legal purposes and a sale of assets, instead of stock, for US federal and state income tax purposes.

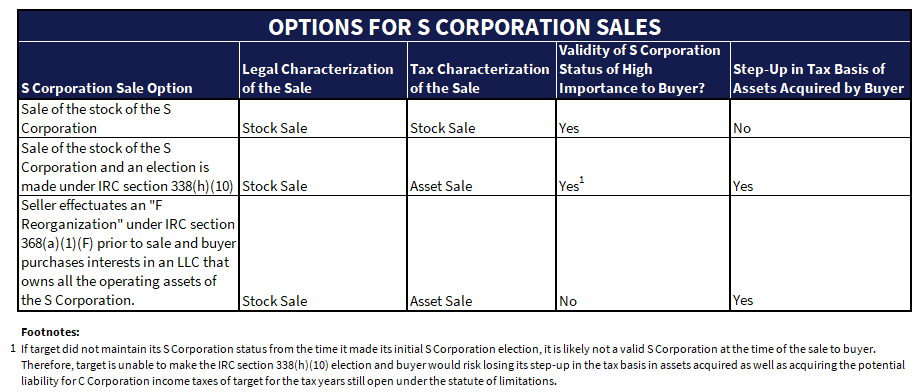

The chart below depicts potential tax characterizations of a sale from a US federal and state income tax perspective. Depending on the entity’s income tax classification, the characterization can differ from a legal perspective.

An S Corporation is one type of income tax classification where there is flexibility in structuring a sale as either a stock or asset sale from a US federal and state income tax perspective.

An S Corporation is a small business corporation for which an election under Internal Revenue Code (“IRC”), Subchapter S, section 1362(a) is in effect. Subchapter S treats the electing S Corporation as a pass-through entity where all taxable income/(loss) passes through, or flows directly, to the shareholder(s) and is reported by the shareholder(s), without regard to whether the cash actually flows out of the S Corporation to the shareholder(s). Subchapter S provides the shareholder(s) a corresponding increase/(decrease) to the tax basis in S Corporation stock for the taxable income/(loss) reported. By operation of these rules, the S Corporation does not pay entity level income taxes, thus avoiding the “double taxation[2]” imposed on C Corporations and their shareholders.[3]

As a pass-through entity, an S Corporation calculates its taxable income/(loss) and separately states certain items to its shareholders each year on a Schedule K-1 in accordance with each shareholder’s respective share of taxable income/(loss) and separately stated items. A shareholder reports its respective share on their income tax return.[4] The rate of tax imposed on the income/(loss) depends on the tax characterization of the income/(loss) as reported on the income tax return. Ordinary income is taxed based on how they file their income tax returns (e.g., single, married filing jointly) and their income tax bracket (highest income tax rate is 37% in 2024) whereas capital gains and qualified dividends are currently taxed at preferential tax rates (highest rate for both is 20% in 2024).

To qualify for and retain an S Corporation designation, a company must adhere to many strict requirements, such as it cannot:

- Have more than 100 shareholders;

- Have as a shareholder a person (other than an estate, certain trusts, and certain exempt organizations) who is not an individual;

- Have a nonresident alien as a shareholder; and

- Have more than one (1) class of stock.[5],[6]

If an S Corporation is not in compliance with all the requirements to qualify or maintain S Corporation status, it automatically loses its status as an S Corporation and immediately converts to a C Corporation subject to corporate-level income tax. It can be difficult to determine whether a target entity has maintained its S Corporation status throughout its existence, which creates complexity in performing tax due diligence.

There are three (3) main options to consider when structuring the sale of an S Corporation (when selling stock from a legal perspective) from a US federal and state income tax perspective.

To determine if it is preferential to structure the sale of a target S Corporation as an asset sale vs. stock sale for US federal and state income tax purposes, there are some key items both parties should take into consideration:

- Is there uncertainty that the target maintained its S Corporation status for the entire time since it made its initial S Corporation election? How heavy of a lift will it be to perform tax due diligence to confirm maintained status?

- Was the target (or a subsidiary of target) ever a C Corporation prior to its conversion to an S Corporation (or qualified subchapter S subsidiary)? Were there built-in gains at the time the C Corporation converted to an S Corporation?

- Will selling S Corporation shareholder(s) retain any portion of ownership in target, or will they sell 100% of target stock?

- Will the purchase price be entirely cash, or will a portion be stock in buyer?

- What is the expected gain/(loss) for US federal and state income tax purposes if S Corporation shareholders(s) sell stock as compared to assets? This comparison should take into account the transaction costs of effectuating an asset sale and the value of the potential step-up in the tax basis to the buyer as a result of an asset sale.

- What is the difference, if any, in the estimated tax incurred by selling S Corporation shareholder(s) if they sell stock vs. assets for US federal and state income tax purposes? Will the seller(s) require the buyer to pay them a gross-up payment?

- What is the proposed purchase price allocation of the total value received by selling S Corporation shareholder(s) if the sale is structured as a sale of the target’s assets (IRC section 1060 allocation)?

- If all the gain recognized on the sale of target is with respect to goodwill or other “capital” assets, then it is unlikely that there is a difference to selling S Corporation shareholder(s) on the sale of stock or assets from a US federal and state income tax perspective.

- Is there depreciation recapture[7] that needs to be considered with respect to gain recognized on the target’s depreciable assets?

- This will cause potential capital gain to be recharacterized as ordinary income to the seller(s) on an asset sale.

- Does the tax structure create increased complexity and administration?

- What are the legal costs and timing required to effectuate the proposed tax structure?

How Centri Can Help

Centri’s M&A Tax Advisory team can support your company through all stages of the M&A life cycle, including the time you build, manage, and enhance your business organically and when you are ready for a purchase or sale. Our team includes our National Office of former Big 4 professionals who have over 40 years of experience in their respective fields. We utilize our vast deal experience to provide a unique value measurement solution, enabling you to achieve your goals through successful planning and execution of both buy-side and sell-side transactions. Contact us to learn how our tax due diligence and structuring experts can help your company succeed.

[1] Throughout this article, the term “stock” will be used for simplicity as inclusive of any equity instrument such as stock, membership interests, partnership interests, etc.

[2] A C Corporation pays entity-level income taxes, and its shareholders pay income taxes on any distributions from the C Corporation that are classified as dividends or capital gains.

[3] IRC section 1363.

[4] IRC section 1366.

[5] IRC section 1361(b).

[6] There are additional requirements to retain S Corporation status in addition to the items noted above (e.g., passive investment income limitation rules).

[7] IRC section 1245 and 1250.

Managing Director | Tax Advisory | CPA

Brittany is a Managing Director at Centri Business Consulting. She has more than 14 years of experience assisting clients with tax issues pertaining to mergers and acquisitions, sell-side transactions, attribute services work, tax due diligence, legal entity rationalization and structuring, corporate compliance & provisions (ASC 740), financial modeling, and corporate restructurings for domestic and cross-border transactions involving multinational corporations and S corporations. View Brittany Burke's Full Bio

Senior Director | Tax Advisory Practice | CPA

Frank is a Senior Director at Centri Business Consulting in the firm’s Tax Advisory Practice. He joined Centri in November 2023. He has over 40 years of experience guiding domestic and international companies in forward-thinking, transparent tax planning to create more efficient and sustainable business entities. Over the course of his career, he has supported clients across the manufacturing, wholesale, retail distribution, energy, and technology industries on cross-border tax structuring, data-driven tax rate consulting, acquisition and post-integration planning, and regulatory compliance.. View Frank Angeleri's Full Bio

Senior Director | Tax Advisory Practice | JD/LLM

Dave is a Senior Director, Quality Control at Centri Business Consulting. He joined Centri in April 2024 and assists clients with tax advisory services.. . View David Madden's Full Bio

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 10

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com